Motor Insurance

Motor Insurance

What is Auto Insurance?

As per Indian Motor Vehicles Act 1988, Auto insurance policy is mandatory for vehicle owners. This Plan is designed to give coverage for losses which the insured might incur in case his motor gets stolen or damaged. The amount of Auto insurance premium is decided based on the Insured Declared Value of the vehicle. The premium increases if anyone raises the IDV limit and vice versa.

Why do I need to insure my vehicle?

According to the act, Auto insurance is mandatory for all vehicles that ply on roads-like car, trucks, etc. The prime objective of this type of insurance is to provide complete protection & coverage on physical damage or loss from man-made & natural disasters. Hence, you need to insure your vehicle.

Key Features of Auto Insurance

- Policy protection against the loss or damage to the covered vehicle.

- Coverage against financial liability caused due to injury, death of a third party or damage to the property.

- Personal Accident Coverage.

- Auto Insurance protects you for the below mentioned damages, should they occur:-

| Accident | Fire | Lightening | Explosion |

|---|---|---|---|

| Self-Ignition | Transit by Rail, Road, Air & Elevator | Theft | Terrorism |

| Earthquake | Riot & Strikes and / or Malicious Acts | Flood, Cyclone | Inundation |

Types of Auto Insurance

1) What is Auto Insurance?

This insurance gives coverage against accidental damage or losses to the holder’s vehicle or third party. The amount of premium depends entirely on making of the car, manufacturing year, its value & state of registration.2) Two Wheeler Insurance

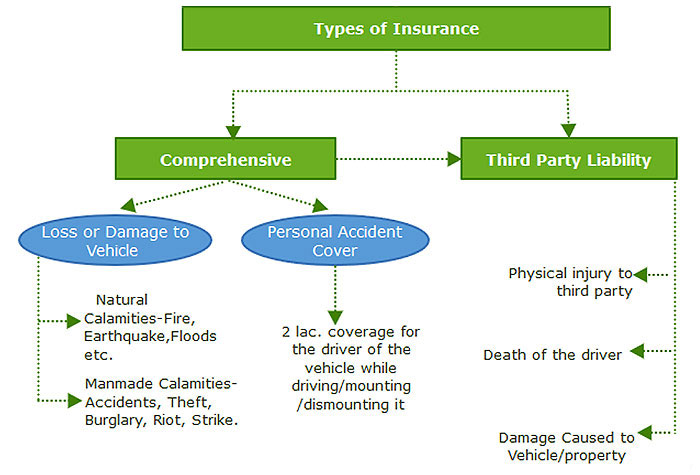

This type of insurance is for scooters, bikes & features that are similar to four-wheeler insurance.3) Comprehensive Coverage

This type of coverage offers you a complete package policy wherein any damages to the vehicle will be covered up to the Insured Declared Value. Any third party property damage or third party injury/death can be covered in this. Policyholders feel less stressful as it gives them end-to-end coverage.

4) Third Party Liability Coverage

Under the Motor Vehicles Act, third party liability coverage is legally mandatory. This type of auto insurance offers coverage against all legal liabilities to a third party caused when insured vehicle owner is at fault. It insures injury/damage caused by policyholder to third person/property.

5) Collision Coverage

It financially protects the policyholder against damage of insured’s own car. Collision coverage pays the policyholder for damage caused because collision which generally occurs due to an accident.

6) Add-On Riders

Add-on riders doesn't take the depreciation value of the parts & allows you to receive the entire claim amount. It is generally available for cars under three years & allows eligibility to claim full amount for replacing/changing any damaged parts of your vehicle.

Exclusions from Auto Insurance

- General ageing, wear and tear

- Damage by a person driving without a valid driving license

- Mechanical or electrical breakdown, failure

- Damage by a person driving under the influence of Liquor/Alcohol/Drugs

- Depreciation, any consequential loss

- Loss /Damage attributable to War /Mutiny /Nuclear risks

- Damage to tyres and tubes are excluded unless the vehicle is damaged at the same time. In such circumstance, the liability of the company shall be limited to 50% of the cost which includes replacement Loss /Damage

Important points to remember in the event of an accident

These documents must always be in your vehicle:-

- Copy of policy/cover note

- Car Registration Copy (RC Book)

- Driving License Copy

To Initiate The Claim Process

- Register an FIRNote down the vehicle number involved in the accident, witness name and contact details. Initiate the claim process by calling on toll-free number and providing the required details.

- Get in touch with the contact centre & inquire for the network garage nearby. And in case, should you visit a non-networked garage, the bills will be settled after ascertaining the damages caused.

FLYING STARS

FLYING STARS